Panama Real Estate Market Report Period 2023

Below, we present various metrics that offer a detailed view of the Panamanian real estate market, with the aim of providing accurate information and expert guidance to our clients to make informed decisions and take full advantage of the opportunities offered by this dynamic sector.

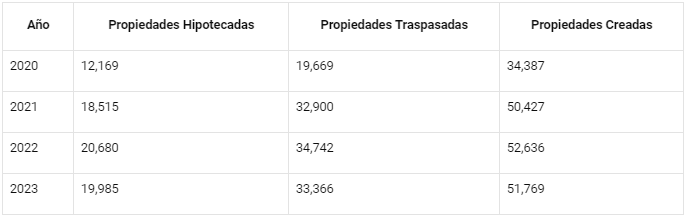

Comparison of Registered Properties (Mortgaged, Transferred, and Created) between 2020 and 2023:

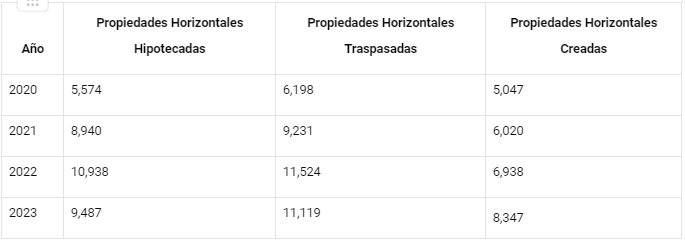

Comparison of Registered Horizontal Properties (Mortgaged, Transferred, and Created) between 2020 and 2023:

Source: Public Registry of Panama

MLS QUARTERLY REPORT OCTOBER 2023 - DECEMBER 2023 2ND QUARTER. (Based on statistical report from Xposure MLS Acobir System)

RESIDENTIAL CLOSINGS

During the second quarter of 2023, according to the quarterly MLS report, significant numbers were observed in residential closings for both sales and rentals.

Regarding sales, 67 residential units were completed, generating a total volume of $17,714,798. The average sales price stood at $264,400, reaching a high of $925,000. Additionally, an average discount of 11% was applied to the sales price, and the closing process averaged 203 days.

On the other hand, in the area of rentals, 43 closed units were registered, adding a total volume of $57,338. The average rental price was $1,333, with a high of $5,500. An average discount of 3% was applied, and the average closing time was 63 days.

This data offers a detailed view of residential market activity during the second quarter of 2023, providing insights into prices, discounts and closing times for both sales and rentals.

The numbers of closed listings vary in each area, with San Francisco recording the highest number with 25, followed by Playas del Pacífico with 15 and Juan Díaz with 13. On the other hand, areas like Betania and Ancón had less activity, with only 1 and 3 listings closed respectively.

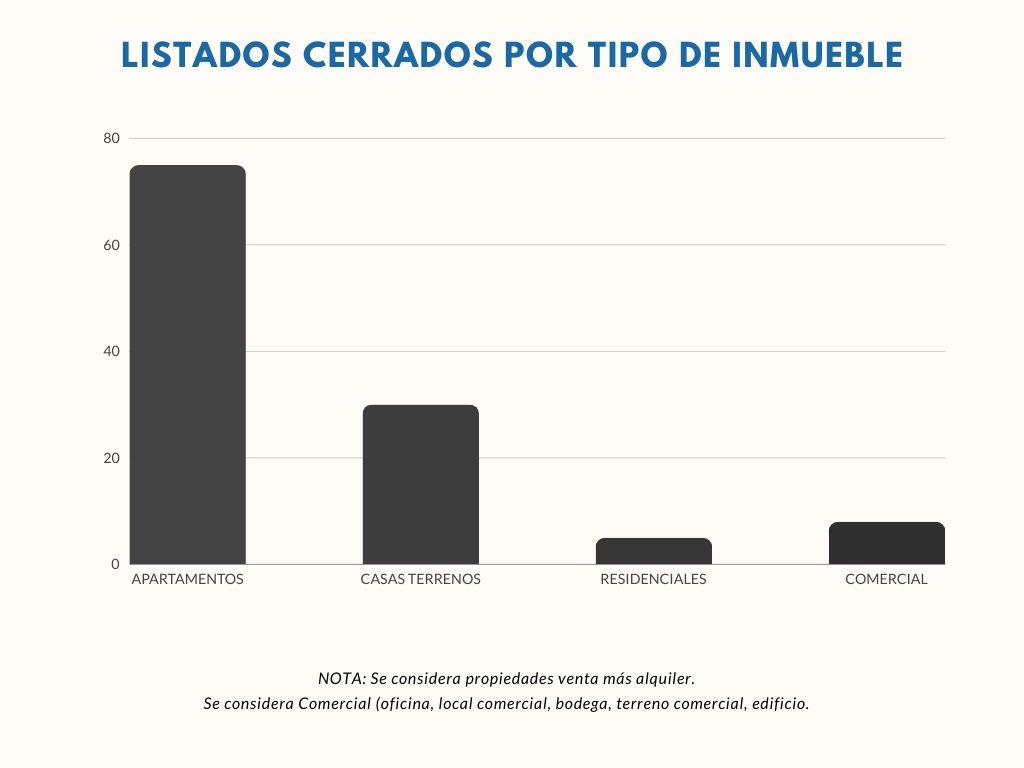

This analysis highlights the diversity of the real estate market in Panama, with a wide range of options available to both investors and buyers. While apartments lead in terms of transactions, house and land options also remain relevant. Additionally, the presence of residential and commercial properties signals the dynamic nature of the market, offering opportunities for residents and entrepreneurs alike.

Most sales transactions were concentrated in the $250,000 to $500,000 price range, with a total of 21 closed listings. Listings with prices over $500,000 followed, with 8 closings.

On the other hand, there were a considerable number of transactions in the $180,000 to $250,000 price range, with 19 listings closed. Lower prices also saw activity, with 9 closings of listings with values under $100,000.

For rentals, a more uniform distribution in price ranges was observed. Most rentals were in the $1,000 to $2,500 range, with 25 closed listings in total. Rentals priced between $1,000 and $1,500 accounted for the most transactions, with 13 closings. In contrast, there were only 2 closings of listings with rents over $4,000.

These data reveal the price preferences of buyers and renters in the Panamanian real estate market, highlighting constant demand in the middle price ranges and activity at the extremes. This information is crucial to understanding market trends and making strategic decisions in the future.

.png?1710448598829)

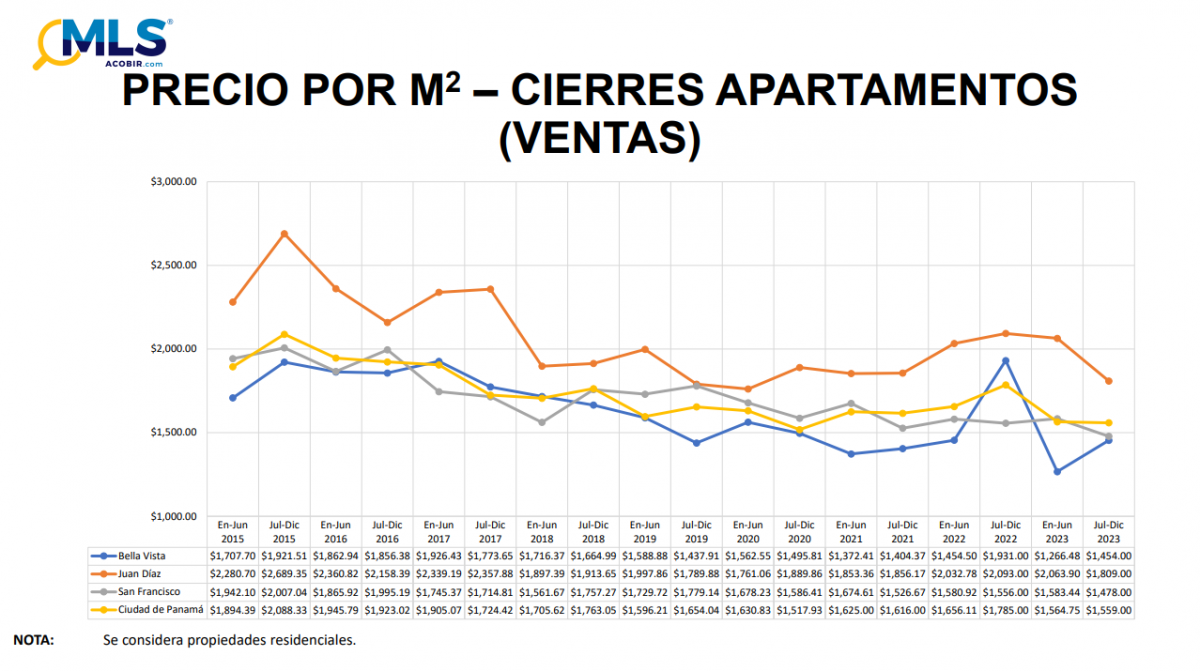

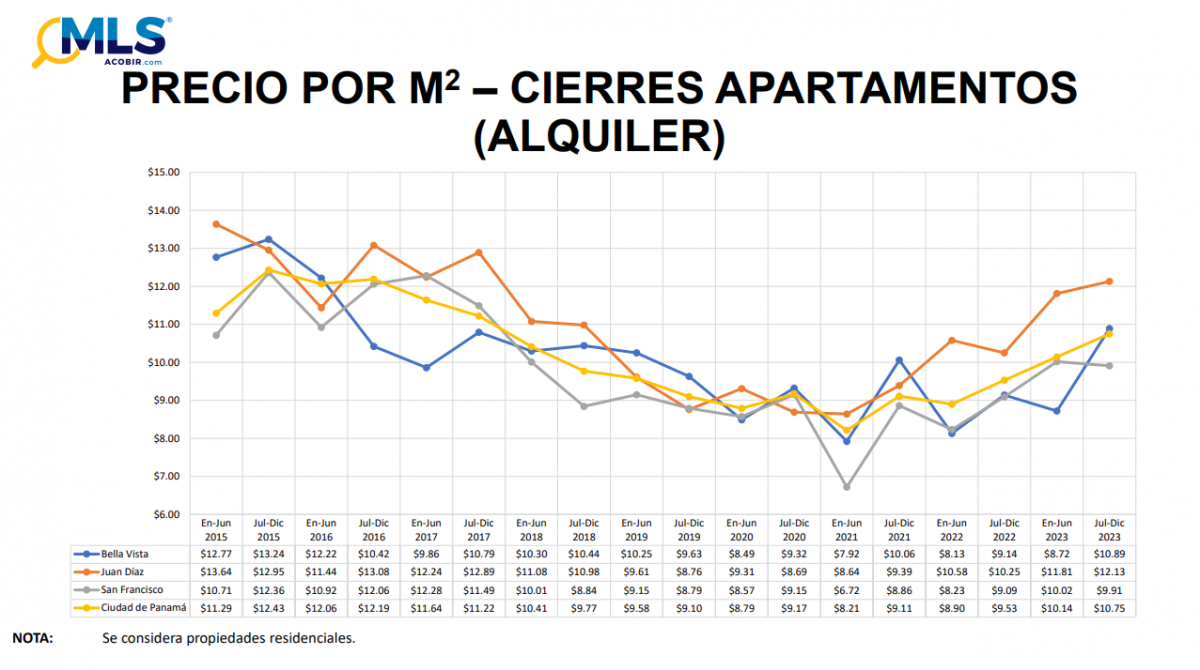

Regarding the price per square meter of apartments sold on the secondary market in Panama City, the average price remained at $1,552.73, a figure that has been decreasing since 2015 but seems to have stabilized in recent semesters. On the contrary, the price per square meter of rented apartments last semester showed a slight increase to $10.71, a figure that has been rising in recent semesters since the high unemployment that occurred in the city after the pandemic was overcome.

Source: MLS Acobir Statistical Report Fourth Quarter 2023

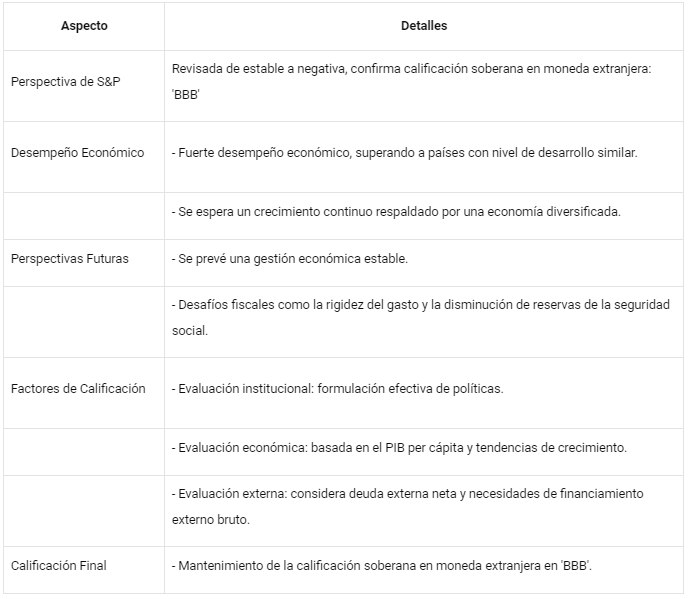

Risk Ratings

Conclusion

The exhaustive analysis of the metrics of the Panamanian real estate market provides a comprehensive view of its current dynamics and possible projections for the year 2024. Although a decrease in sales prices is observed, there is a significant improvement in the price per square meter, suggesting a recalibration of the market in terms of unit value. However, it is important to highlight that sales volume has experienced a notable decrease, reflecting lower transactional activity compared to previous periods.

Regarding rental prices, there has been a significant increase, indicating greater demand for rental properties. This trend may be driven by factors such as labor mobility, urban growth and investor preference for the rental market. Despite the existence of a considerable supply, rentals seem to be more valued in the current market.

Regarding the political landscape, it is important to recognize that Panama has maintained notable democratic stability in recent decades, compared to other countries in the region. However, political challenges and tensions remain that may influence the market, although their direct impact on the real estate sector may be limited.

Furthermore, the evaluation of profitability and associated risks provides valuable information for real estate investors. Despite economic and fiscal challenges, Panama remains an attractive investment destination, supported by solid economic performance and effective policy management.

In summary, while the Panamanian real estate market is expected to continue showing positive dynamics in 2024, it is essential that investors carefully evaluate the opportunities and associated risks. This involves considering the specific trends of each market segment and geographic region, as well as political and economic factors that may influence market behavior.

At Servmor Realty, we are committed to providing our clients with detailed analysis and expert guidance to make the most of investment opportunities in the Panamanian real estate market in the coming year and beyond.